Release time:2024-01-22

Release time:2024-01-22

Viewed:160271 times

Viewed:160271 times

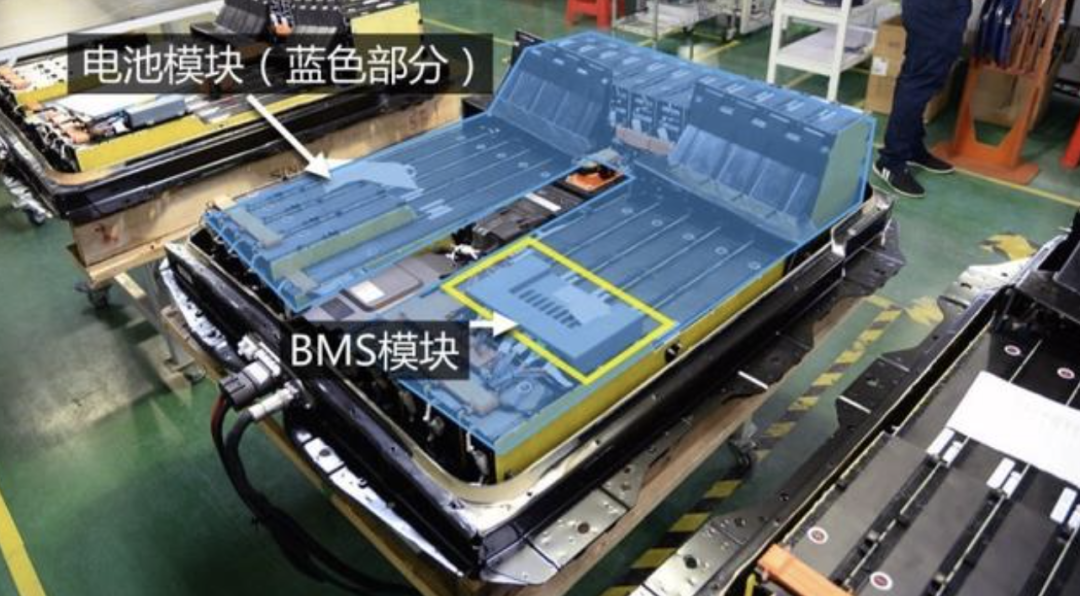

In electric vehicles, 40% of the cost comes from batteries, which are like the heart that provides "pumping function" for electric vehicles. The performance and lifespan of batteries are important indicators for measuring the performance of electric vehicles. How to master these indicators and ensure that each battery operates optimally?

It all relies on the Battery Management System (BMS), which plays the role of a "battery nanny" in the battery operation system. It processes sufficiently rich signals, including battery cells, collisions, CAN, charging, water pumps, high voltage, insulation, and so on.

A single over discharge can cause permanent damage to the battery, and in extreme cases, overheating or overcharging of lithium batteries can lead to thermal runaway, battery rupture, and even explosion. Therefore, BMS can accurately measure the usage status of the battery pack, protect the battery from overcharging and discharging, balance the power of each battery in the battery pack, and analyze and calculate the power of the battery pack and convert it into understandable endurance information to ensure the safe operation of the power battery.

What are the main chips in BMS?

AFE module: realizes functions such as battery information collection and status monitoring

AFE (Analog Front End) is an integrated component that includes sensor interfaces, analog signal conditioning circuits (including impedance conversion, programmable gain amplification, filtering, and polarity conversion), analog multiplexers, sampling and holding devices, ADCs, data caching, and control logic components for storage and control logic. Some AFEs also come with MCU, DAC, and various driver circuits.

Battery balancing module: improving battery life and cycle life

Unbalanced batteries can affect battery life and cycle life. The imbalance of batteries is manifested by the unequal voltage of each battery when multiple batteries are connected in series, especially at the charging and discharging ends. When batteries with different fully charged capacities are connected in series, the charging current in series is the same, but the battery with a smaller fully charged capacity will first charge to a higher voltage, resulting in unequal voltage across each cell. Even if the full charge capacity is the same, when batteries with different SOC are connected in series, the voltage of the battery with higher SOC is higher, resulting in unequal voltage across each battery. Even if the full charge capacity and SOC are the same, but the internal resistance R of each battery is different, the IR pressure difference during charging and discharging will be different, whichwill also lead to different battery terminal voltages. In addition, some external factors (such as local temperature of the battery pack or thermal imbalance between individual batteries) can also lead to different aging rates of individual batteries, resulting in uneven internal resistance. Ultimately, it may manifest as unequal voltage across each battery cell.

The balancing circuit mainly includes active balancing and passive balancing. Active balancing is the process of transferring the excess energy from the battery cell with the highest battery capacity to the battery cell with the lowest battery capacity, or to the entire battery string, to achieve energy recovery. Passive balancing is the process of consuming the excess energy from the battery cell with the highest battery capacity through resistance heating.

Computing unit (MCU, etc.): Implement control, calculation and other functions

As a computing platform, MCU needs to meet certifications such as AEC-Q100 and ISO26262. Taking the ADI 48V hybrid BMS system as an example, the MCU plays a role in relay control, SOC/SOH estimation, balance control, cell voltage, current, temperature data collection, and data storage. Compared to consumer and industrial grade MCUs, automotive grade MCUs have higher industry barriers. Automotive grade semiconductors have high requirements for product reliability, consistency, safety, stability, and long-term effectiveness, making research and development difficult. The external temperature difference during vehicle operation is large, and there are high requirements for the wide temperature control performance of chips; In terms of product lifespan, the designed lifespan of the entire vehicle is usually 15 years or more, far exceeding the lifespan requirements of consumer electronics products; In terms of failure rate, vehicle manufacturers usually require zero failure for automotive grade semiconductors; In terms of safety, the high functional safety standards of automotive electronics provide sufficient security guarantees for the increasing complexity of electronic systems in mass production. The supply cycle of automotive grade semiconductors needs to cover the entire lifecycle of the vehicle, and the supply needs to be reliable, consistent, and stable, which poses high requirements for enterprise supply chain configuration and management.

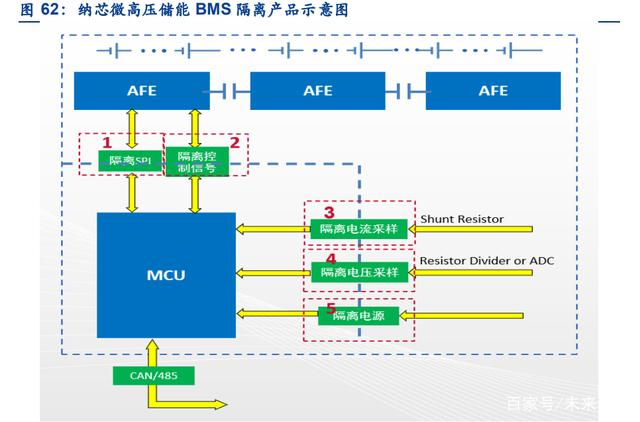

Isolation circuit: achieving electrical isolation between high and low voltage modules

Isolation devices achieve electrical isolation between high and low voltage modules, and the technical route includes optocoupler isolation and digital isolation. Isolation device is a safety device that can convert and output input signals to achieve electrical isolation at both input and output ends. Electrical isolation can ensure the safety of signal transmission between strong and weak circuits. If electrical isolation is not carried out, once a fault occurs, the current from the strong circuit will directly flow to the weak circuit, causing damage to the circuit and equipment. In addition, electrical isolation removes the grounding loop between two circuits, which can block the propagation of common mode, surge and other interference signals, making electronic systems more secure and reliable. The equipment for signal transmission between high voltage (strong current) and low voltage (weak current) mostly requires electrical isolation and safety certification. Widely used in various fields such as information communication, power meters, industrial control, electric vehicles, etc.

The main manufacturers of BMS chips are in Europe and America

There are not many AFE options available in BMS chips. The internal structure of AFE that we can encounter is similar, with differences in the number of sampling channels, the number, type, and architecture of internal ADCs.

AFE's main suppliers include ADI, TI, ST, Panasonic, NXP, and Renesas. Among them, ADI's product line mainly comes from the acquisition of Lingleite and Meixin (in 2019, after acquiring Lingleite, ADI collaborated with vehicle companies such as General Motors to develop wireless BMS, launched wireless BMS systems and platforms, and tested battery data and analyzed it throughout the entire cycle from battery production to recycling to maximize the value of power batteries), while Renesas's products mainly come from the acquisition of Intersil. The suppliers of AFE products are mainly foreign enterprises, and currently there is no domestic manufacturer providing AFE chips.

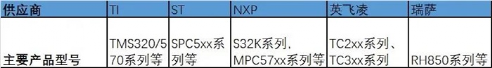

AFE's main suppliers and product models

From the perspective of MCU, the main suppliers include TI, ST, NXP, Infineon, Renesas, etc. At present, many domestic MCU manufacturers are actively laying out automotive grade products, such as Zhongying Electronics, Zhaoyi Innovation, Beijing Junzheng, Xinhai Technology, National Technology, Ziguang Guowei, Nasda, Lexin Technology, Botong Integration, Fudan Microelectronics, Shanghai Beiling, Jingfeng Mingyuan, and so on.

Main MCU suppliers and product models

In terms of ADC, the main suppliers currently include TI, ADI, ST, Renesas, etc., most of which are American manufacturers. Although ST has, its product line is relatively limited. In China, there are mainly Shanghai Beiling, Siripu, Shengbang Group, and Xinhai Technology.

In terms of digital isolation, it is mainly used for digital communication between high and low voltage, such as SPI communication between high voltage sampling on the BMS main control board and MCU, as well as SPI communication between sampling board AFE and MCU. The main suppliers include ADI, TI, Silicon Labs, etc. Of course, in addition to using digital isolators, optocouplers or transformer isolation schemes can also be used.

Representative BMS chips

TI high-precision battery monitoring, balancing, and protector

The rapid development of automotive electrification is irreversible, and the BMS system has become the primary core issue. TI has made significant achievements in the field of electric vehicle BMS, and has successively released wired BMS and wireless BMS solutions that comply with ASIL D standards, leading the industry.

BQ79614-Q1 Circuit Topology Diagram Source: TI

BQ79614-Q1 is a high-precision battery monitor, balancer, and protector that can be applied to hybrid and pure electric vehicle BMS modules. It can monitor the battery temperature in real-time and can automatically pause and start operations to avoid overheating. The working voltage of this chip is 12V and can operate at 128 μ Quickly conduct high-precision voltage monitoring for 14 batteries within S.

The BQ79614-Q1 chip integrates a front-end filter and a rear ADC low-pass filter internally. The front-end filter is designed to reduce costs by using a simple, low-voltage differential RC filter on the battery input circuit. The ADC low-pass filter is designed to monitor the filtered DC voltage and facilitate the calculation of the battery's charge state. The chip can be used for measuring external thermistors. BQ79614-Q1 can be connected to BQ7600 devices in communication or directly communicate with MCU through UART interface. In case of abnormal communication lines, the MCU can communicate directly with the battery pack through an isolated differential daisy chain.

ST L9963E Battery Monitoring and Protection Chip

STMicroelectronics (ST) has been leading the semiconductor market for many years, with chip applications spanning multiple fields and becoming a major supplier of automotive chips. In the automotive field, in order to meet market and design needs, the L9963E battery monitoring and protection chip has been launched, aiming to solve the battery management system design challenges faced by electric vehicles worldwide, including China. The new product adopts a unique architecture that can measure 4 to 14 series connected battery cells, and there is no delay in releasing synchronization between sample signals. The test results show that although 31 L9963Es can be daisy chain connected, the entire chain delay is still less than 4 seconds.

The voltage measurement accuracy of L9963E is very high, with a maximum error of ± 2 mV, and it can also measure current to understand the actual capacity of each battery cell. In addition, the architecture of the product ensures that each battery cell has dedicated resources for processing the electrical data detected by the chip, while similar products on the market usually share data processing resources between battery cells. By providing dedicated processing resources for each individual unit, we can provide synchronized readings and avoid delays caused by unsynchronizing. Within the daisy chain network architecture, L9963E can also communicate via serial bus, with a bandwidth of up to 2.66 Mbps, while most industry bandwidth is hovering around 1 Mbps. Therefore, reading and processing 434 battery cells takes 4 milliseconds to 16 milliseconds.

EVAL-L9963E-MCU

As electric vehicles become cheaper, cost constraints become more important. Chips that are powerful but priced too high will lose most of their appeal. What sets L9963E apart is that it offers a variety of features, but without increasing the bare chip size, it continues to maintain cost-effectiveness. In addition, traditional BMS chips require each battery cell to be connected in parallel with an external Zener diode. During the assembly process, the system cannot determine which battery cell first contacts the connector, and this is always a random event. Therefore, the Zener diode on each battery cell must protect the battery management chip. L9963E adopts hot swappable and robust architecture, allowing engineers to eliminate the need for these Zener diodes, simplifying the layout of printed circuit boards and reducing overall costs.

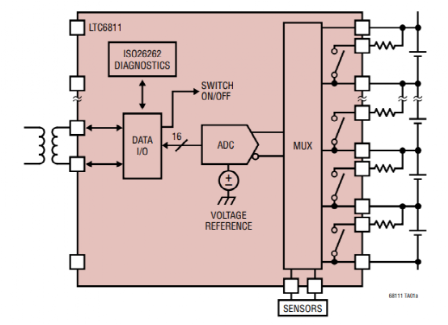

ADI 12 channel battery monitor

According to the ADI official website, the first integrated high-voltage battery stack monitor was launched as early as 2008 and has been iteratively updated to the fourth generation. The fifth generation product is still in the research and development stage.

LTC6811-1 Framework Diagram Source: ADI

LTC6811-1 is the fourth generation BMS IC of ADI, which is a battery pack monitor that can detect voltage on up to 12 series connected batteries. The measurement accuracy is higher than ST L9963, and the total measurement error is less than 1.2mV. Completing 12 battery tests only requires 290 steps μ S. LTC6811-1 can connect multiple batteries in series, so the chip can achieve real-time monitoring of battery status in high-voltage battery strings. The chip also has an ISOSPI interface, which enables high-speed remote communication with the device. The LTC6811-1 can connect 12 sets of batteries through a daisy chain to achieve multi-channel communication, monitor battery status, and pause and start operations based on the current battery status. The chip is powered by an isolated power supply.

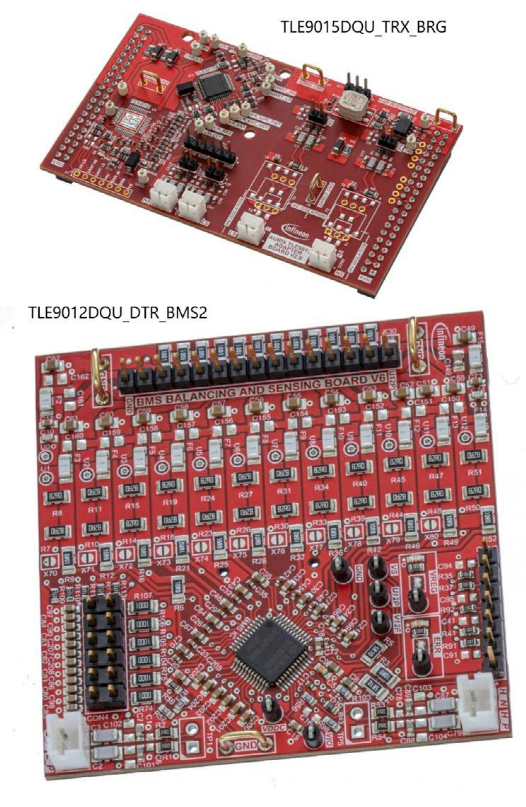

Infineon multi-channel battery monitoring and balancing system IC

Infineon's battery management IC includes two models, TLE9012DQU and TLE9015DQU, providing optimized solutions for battery monitoring and balancing. The new battery management IC can achieve higher measurement accuracy and excellent application robustness, providing a systematic solution for the battery topology structure of battery modules, module free battery technology, and integrated battery chassis technology. It can enable the automotive battery management system (BMS) solution to meet the highest level of ASIL-D functional safety requirements and comply with ISO26262 standards.

Infineon's IC products are suitable for industrial, consumer, and automotive applications, such as mild hybrid electric vehicles (MHEVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and pure electric vehicles (BEVs), as well as energy storage systems, battery management systems for two and three wheel electric vehicles, and other applications. This IC series of products includes two models, TLE9012DQU and TLE9015DQU.

Among them, TLE9012DQU is a multi-channel battery monitoring and balancing system chip that can perform highly accurate voltage measurement to estimate battery charging state (SoC) and battery health state (SoH), which is also a key requirement that all battery management systems must meet.

TLE9015DQU is a battery monitoring transceiver chip used to connect multiple TLE9012AQUs in lithium batteries in a daisy chain structure. Through two pairs of UART and iso UART interfaces, ring communication can be supported, reducing costs and improving system efficiency. By integrating a fault management unit, this module can also achieve bidirectional information flow.

How is the domestic BMS chip doing?

At present, the domestic BMS chip market size is billions of pieces per year, with only 20% of the market share from domestic brands, and very few can be used for electric vehicles. Most of them are monopolized by foreign manufacturers, and domestic BMS companies only carry out secondary development on this basis, including hardware design and software construction.

However, domestic semiconductor companies have already made some layout in the BMS chip field. Due to the impact of COVID-19, the global BMS market growth rate decreased in 2020. However, China's BMS market still occupies an important position. According to the Huajing Industry Research Institute, the demand scale of China's BMS market in 2020 was 9.7 billion yuan. In the future, with the expansion of the electric vehicle market and the improvement of battery efficiency requirements, the BMS market size is expected to achieve stable growth. According to Business Wire estimates and the Forward Industry Research Institute, the global BMS market size is expected to be 6.512 billion US dollars in 2021, and is expected to reach 13.1 billion US dollars by 2026, with a CAGR of 15%. According to Mordor Intelligence, the global battery management chip market is expected to reach 9.3 billion US dollars in 2024, with a broad market space.

Where have the discarded batteries of electric vehicles gone?

The sales of electric vehicles in China have been increasing since 2015. With the continuous growth of ownership, as of the end of March 2022, the total number of electric vehicles in China reached 8.915 million, accounting for 2.90% of the total number of vehicles.

Although BMS chips are constantly being upgraded to better optimize battery performance and extend battery life, once the capacity of the power battery decays to 80%, a new battery must be replaced. With the development of electric vehicles in recent years, the number of retired power batteries has shown an increasing trend year by year.

In 2020, the cumulative retired power batteries in China exceeded 200000 tons, and in 2021, this number was about 320000 tons, a year-on-year increase of 60%. The industry expects that power batteries will experience a large-scale retirement trend in the next 2-3 years. After 2025, the number of retired batteries will increase by millions annually.

How to handle retired batteries has become an urgent development challenge for the electric vehicle industry. According to statistics, the current recovery rate of power batteries in China is only around 10%, therefore, the demand for the recycling and utilization of waste power batteries is becoming increasingly urgent.

The Ministry of Industry and Information Technology, the Ministry of Science and Technology, the Ministry of Ecology and Environment, the Ministry of Commerce, and the State Administration for Market Regulation recently jointly issued the "Management Measures for the Cascade Utilization of Power Batteries for New Energy Vehicles" (hereinafter referred to as the "Measures"). The Measures propose to encourage cooperation agreements between enterprises engaged in cascading utilization and enterprises engaged in the production of electric vehicles, power batteries, and the recycling and dismantling of scrapped motor vehicles, strengthen information sharing, utilize existing recycling channels, and efficiently recycle waste power batteries for cascading utilization. Encourage power battery production enterprises to participate in the recycling and cascading utilization of waste power batteries.

On June 17th, the Ministry of Ecology and Environment and seven other departments jointly released the "Implementation Plan for Collaborative Efficiency Enhancement of Pollution Reduction and Carbon Reduction", which clearly promotes the energy supply system

Note: The source and copyright of the article belong to the Power Electronics Technology and New Energy Forum, and Jiemai Technology is only for reprinting and sharing.